Churn is 80% preventable, yet most SaaS companies are not fully aware of this fact. When it comes to securing your revenue, the reality is often surprising: the revenue at risk from existing customers tends to be significantly higher than new revenue opportunities. This means businesses could lose more money by neglecting current customers than they might gain from new sales.

As shown in the real example from an anonymous customer, revenue at risk amounts to $7,909, far exceeding the $1,945.79 in new revenue opportunities.

This sharp contrast highlights the urgent need to focus on retaining at-risk customers rather than only chasing new leads.

What are at-risk customers?

At-risk customers are those who are close to churn, meaning they are on the edge of canceling their subscription or stopping using your service. While it may not initially seem like a major concern, the reality for SaaS companies is that they depend heavily on recurring revenue.

Losing just a few customers can have a significant impact on both monthly recurring revenue (MRR) and annual recurring revenue (ARR).

These customers often show signs (which we will explore later in the article) that they are likely to churn and their retention is essential for sustaining company growth, securing stable revenue streams and developing long-term relationships.

The link between at-risk customers and company performance is undeniable; retaining these customers is often the key to increasing retention rates, securing revenue and sustaining company growth.

Ignoring these customers not only hurts your revenue, but also slows down the overall progress of the company.

“SaaS companies lose 30% of their ARR due to churn, on average.”

Totango

How to find out your at-risk customers?

Identifying at-risk customers is important for preventing churn and securing your revenue. Fortunately, there are signs that can help you spot customers who are likely to leave, allowing you to act before it’s too late.

It has become easier thanks to modern data tools and strategies. SaaS businesses now have several ways to spot customers likely to churn, allowing for timely interventions.

For example, cohort tracking allows you to spot patterns in behavior that lead to churn, making it easier to identify which actions typically lead to cancellations.

Similarly, customer segmentation helps you focus on users who show declining engagement, allowing you to develop targeted re-engagement plans.

Involuntary churn, where a customer doesn’t intentionally cancel but loses access due to failed payments, can also be addressed by automating payment reminders and retries.

Lastly, measuring Net Promoter Score (NPS) and analyzing customer support tickets give you valuable insight into customer satisfaction and recurring issues that may lead to churn.

However, rather than juggling multiple data sources and strategies, tools like UserMotion provide an all-in-one solution for identifying at-risk customers with ease.

Spot at-risk customers and secure your revenue with UserMotion

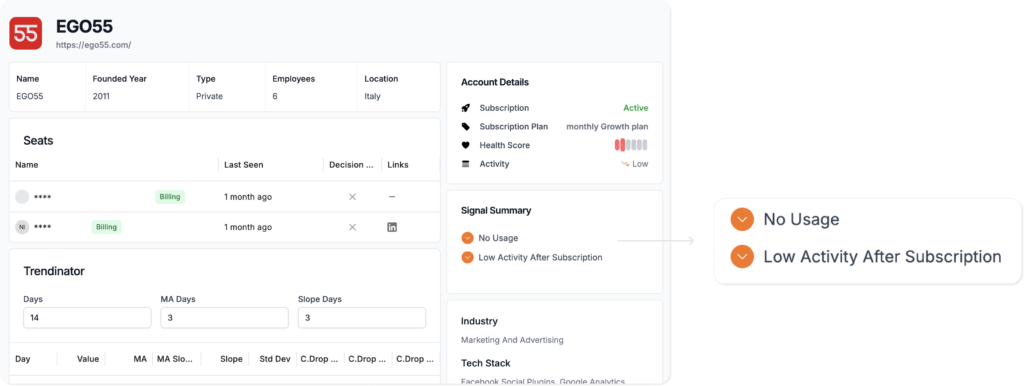

The At-Risk section of UserMotion’s dashboard allows you to instantly view customers in danger of churning, based on real-time data and engagement signals.

As shown in the example, the dashboard provides detailed insights such as:

- Last seen: Track the last time customers logged in or engaged with your product.

- Activity levels: Monitor whether a customer’s activity is low or declining.

- MRR: See how much revenue is at stake for each at-risk account.

- Churn likelihood score: This score combines factors like usage patterns, account age, and interaction history to determine how close a customer is to churning.

- Churn signals: Highlight specific indicators like failed payments, low activity after subscription, or changes in company structure (e.g., decision-makers leaving), which often lead to churn.

By gathering and displaying these key metrics, UserMotion offers a complete view of your at-risk customers at a glance. This makes it easier to take swift action, such as reaching out with personalized re-engagement campaigns or resolving issues related to payment failures.

One of the key benefits of using UserMotion is that it automates much of the heavy lifting involved in churn prevention. Instead of spending valuable time manually analyzing engagement data and creating segmented outreach lists, the platform gives you the information you need to act immediately and secure your revenue.

Example case

For example, in UserMotion’s At-Risk dashboard, detailed information is displayed for each account, highlighting critical indicators such as:

- Account Details: Information like subscription status (whether it’s active or past due), the type of subscription plan (monthly, annual), the health score (which is the overall activity and satisfaction level), and current activity levels (low activity often correlates with a higher risk of churn).

- Signal Summary: This section shows churn signals that contribute to the account’s risk status. In the example provided, we see three major signals:

- High Ticket Customer: The account represents a significant value, making their potential churn particularly impactful.

- No Usage: The account has not been using the product, which is a clear sign of disengagement.

- Company Payment Failed: Failed payments can lead to involuntary churn, highlighting an urgent need for intervention.

Best next actions for different churn signals

Once you’ve identified at-risk customers, understanding the specific churn signals they exhibit is key to deciding the best next steps. Here are the best actions to take depending on the signal:

1. If the signal is high ticket customer, what to do?

When a high-ticket customer is at risk, the potential revenue loss is significant. The key to retaining these valuable accounts is personalized, high-touch engagement. Start by reaching out directly, preferably through an account manager or customer success representative.

Offer to schedule a call to discuss their needs, and explore how your product can provide more value. Additionally, consider offering incentives such as extended trials of premium features or discounts to retain their business.

2. If the signal is no usage, what to do?

No usage is a clear sign of disengagement and possible churn. For these customers, automated re-engagement emails or in-app messages highlighting the value of your product are effective.

Provide tutorials, case studies, or webinars that show how they can maximize their use of your product. You may also want to send personalized outreach offering assistance or support to encourage them to re-engage.

3. If the signal is payment failed, what to do?

Failed payments can often lead to involuntary churn. Automating payment retries is the first line of defense. Send reminders to customers to update their payment information, and if possible, offer alternative payment methods to make it easier for them to continue using your service.

A follow-up from your billing or support team can add a personal touch if the payment issue persists, ensuring that the customer feels valued and supported during the resolution process.

4. If the signal is low activity after subscription, what to do?

Low activity right after a subscription indicates the customer isn’t fully engaging with your product, possibly because they don’t understand its value yet. This is where onboarding is critical.

Automate a personalized onboarding sequence with tips and best practices tailored to their use case. Offering one-on-one onboarding sessions, live demos, or personalized check-ins can help increase engagement and prevent churn.

5. If the signal is decision maker left the company, what to do?

When the decision maker leaves the company, there’s a risk of losing the account, especially if the new leadership isn’t familiar with your product. Immediately reach out to the new point of contact, offering a product walkthrough or demo to demonstrate the value your service brings.

It’s also useful to provide insights into the account’s past usage and ROI to establish your product’s importance to their business. Building a relationship with the new decision maker is crucial for retaining the account.

Start with UserMotion today

Churn prevention is not only about identifying at-risk customers but also about knowing how to respond effectively to the specific signals that indicate potential churn. Whether it’s a high-ticket customer, no usage, failed payments, or other critical signals, UserMotion provides the insights and tools you need to secure your revenue.

Don’t wait until it’s too late—start using UserMotion today to monitor your at-risk customers, take swift action, and secure your recurring revenue. The future of your SaaS growth depends on your ability to prevent churn, and with UserMotion, you’re one step ahead.

People also ask

An at-risk customer is someone who is close to canceling their subscription or discontinuing your service, showing signs of disengagement or dissatisfaction.

Churn risk refers to the likelihood that a customer will cancel their subscription, often due to factors like low activity, dissatisfaction, or failed payments.

Prevent churn by monitoring customer behavior, offering personalized re-engagement, addressing issues proactively, and automating reminders for failed payments.

Secure recurring revenue by focusing on customer retention, offering excellent onboarding, and quickly addressing signals of churn risk with personalized outreach.

Yes, retaining at-risk customers is crucial as they directly impact your recurring revenue and overall business growth.