This is the latest update in our ongoing exploration of B2B SaaS churn rates, featuring key benchmarks from over 1,000 subscription-based B2B companies.

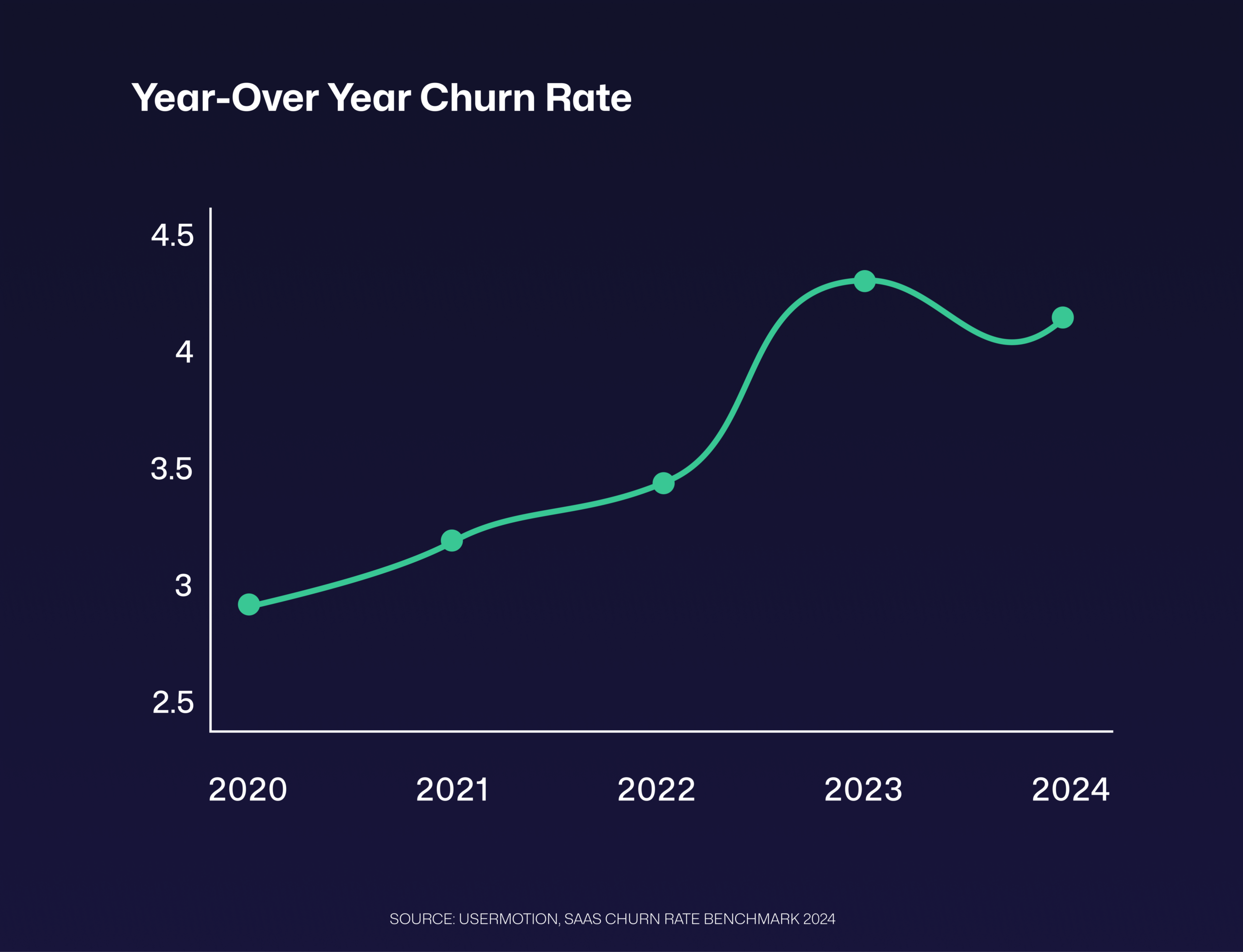

Churn rates in B2B SaaS have steadily increased over the years, peaking at 4.4% in 2023 before dropping to 4.2% in 2024, according to our research and public reports.

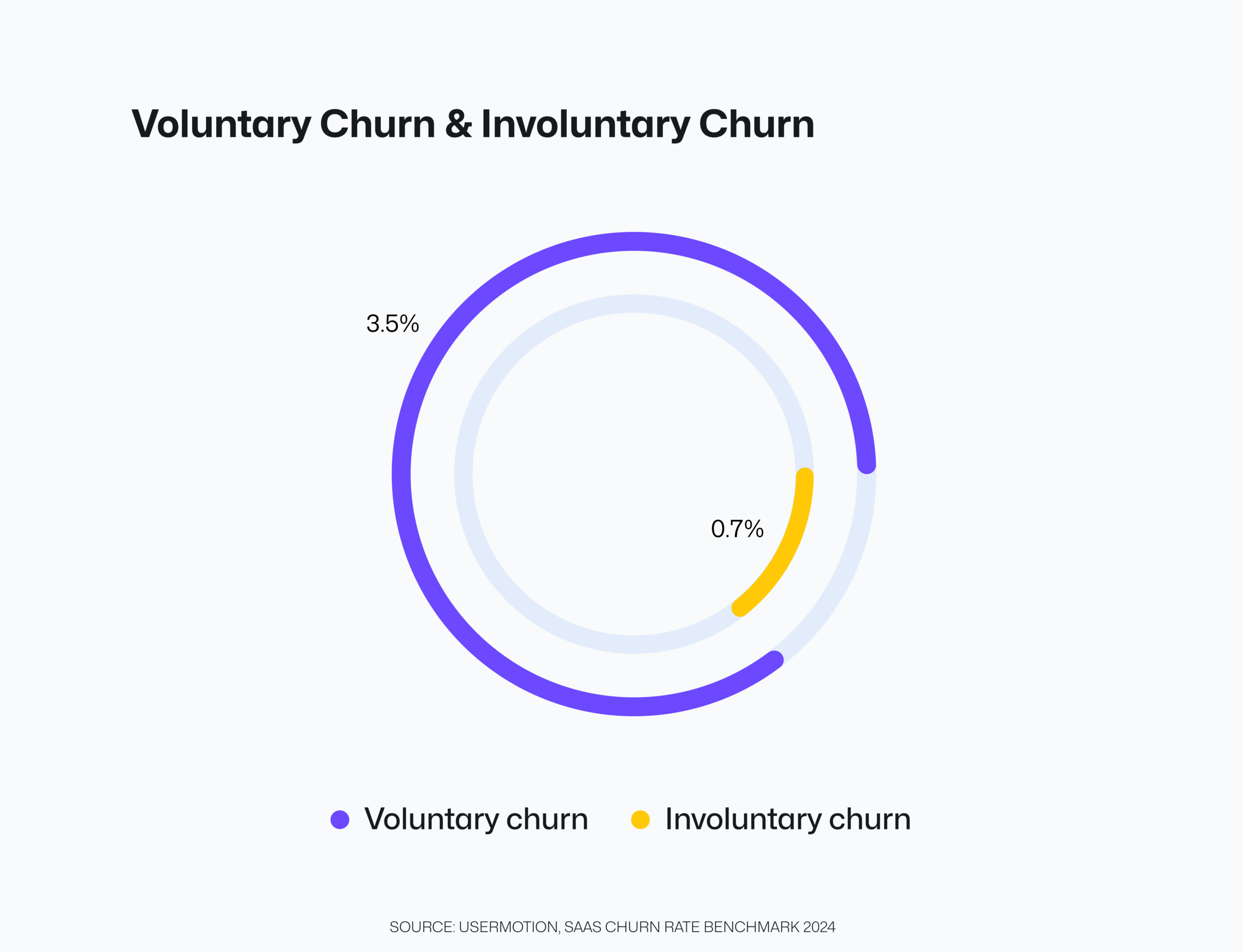

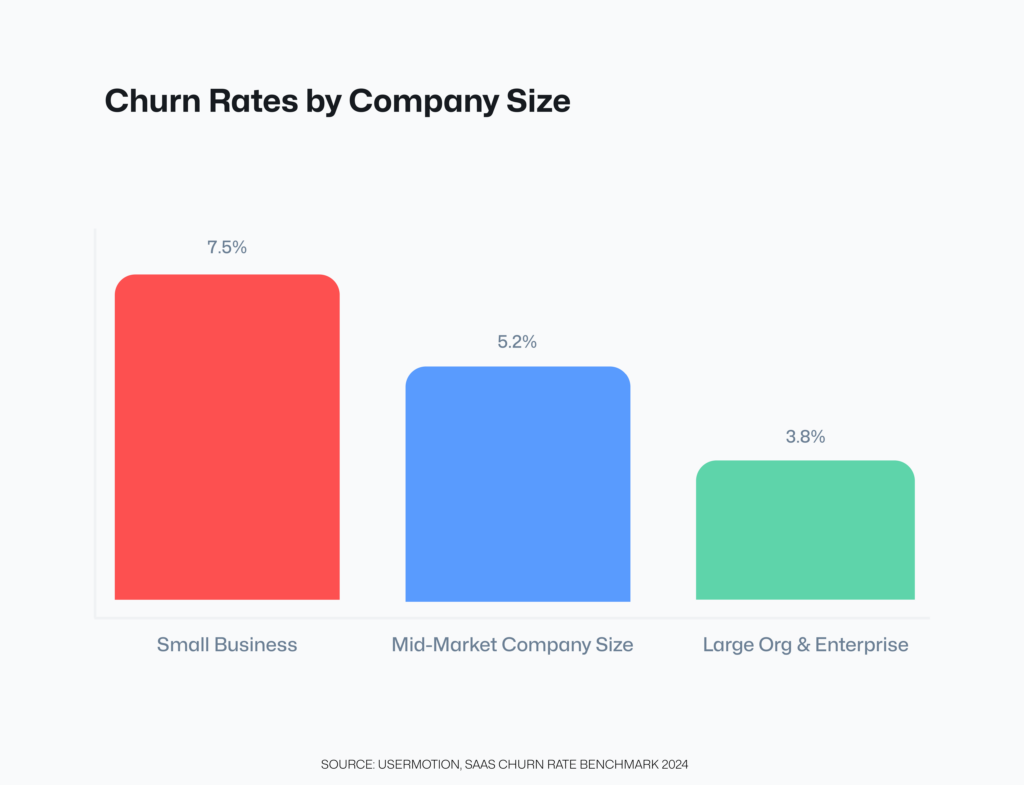

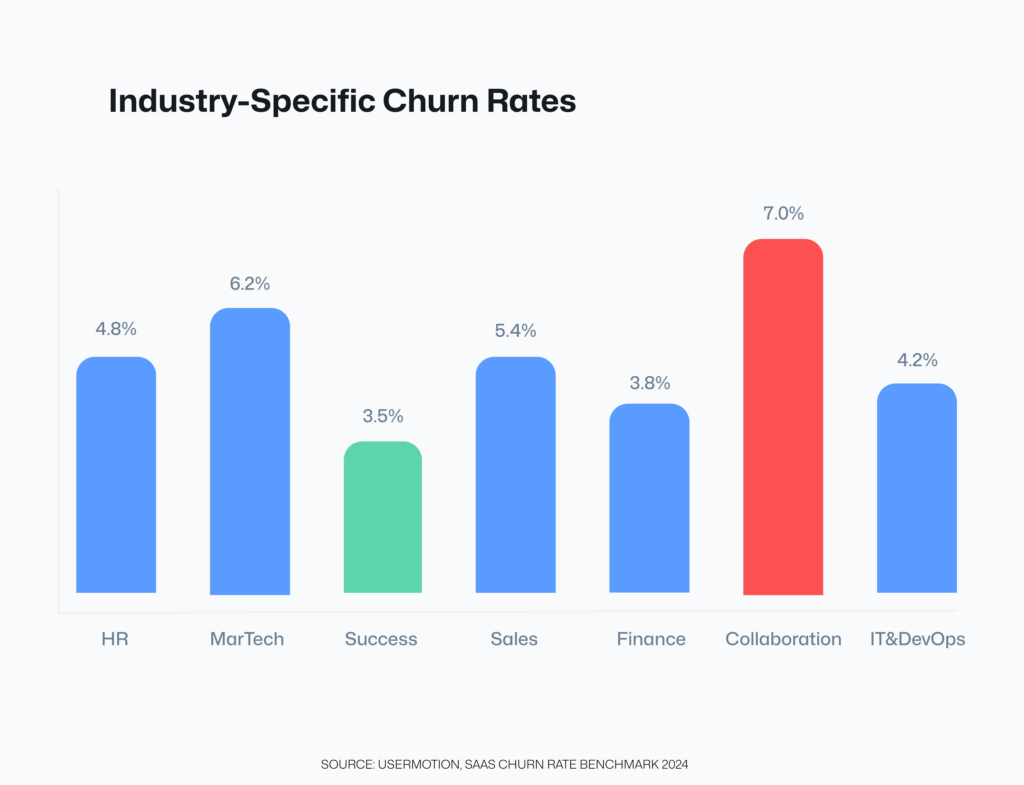

SaaS churn rates depend on factors like pricing, subscription models, and the type of customers a business serves. Our researches show that the average churn rate across over 1,000 subscription-based businesses is 4.2%, with 3.5% coming from customer decisions (voluntary churn) and 0.7 % from issues like payment failures (involuntary churn).

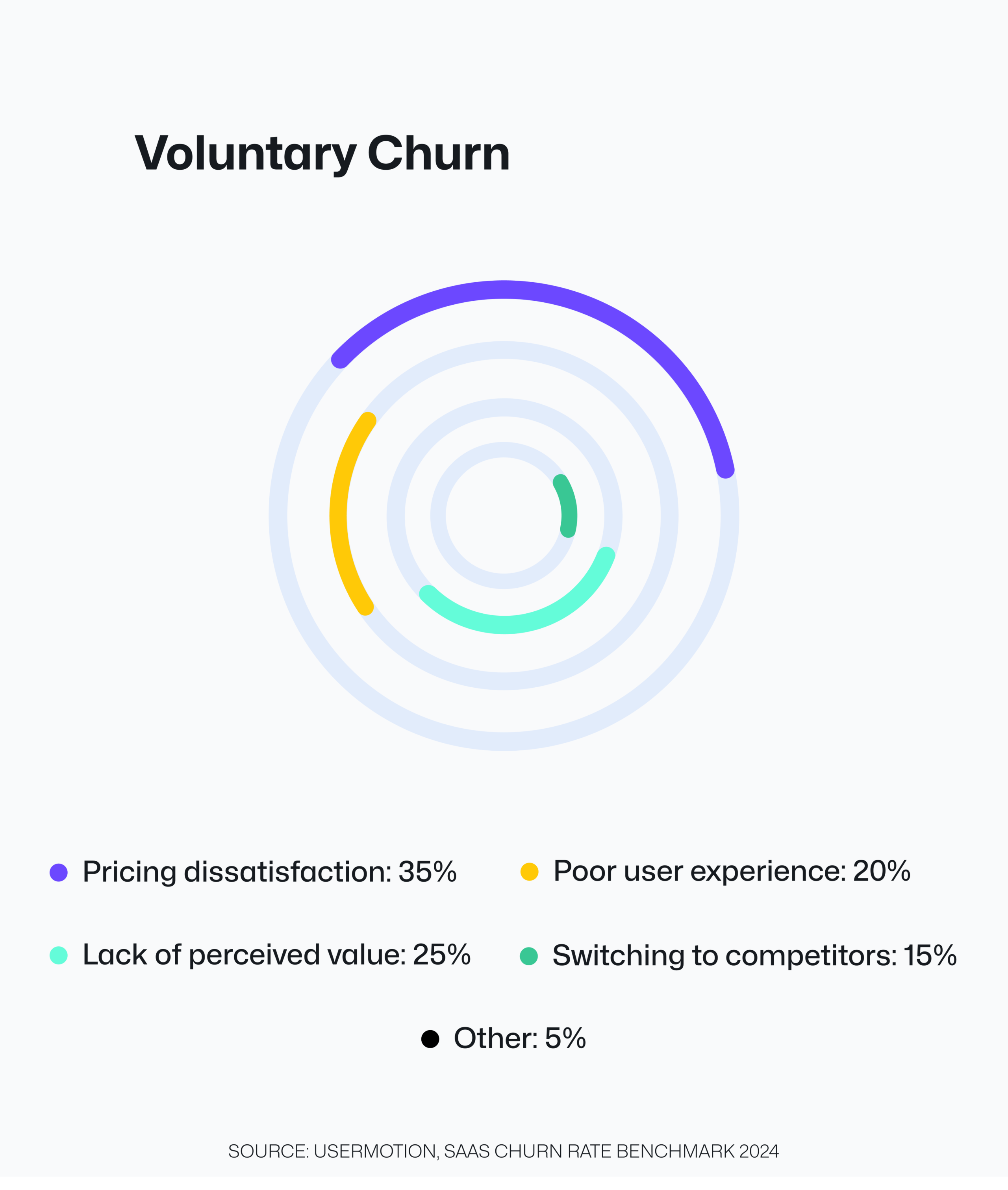

Voluntary churn primarily results from customers opting out due to factors like pricing dissatisfaction, low product usage (lack of value), or better alternatives in the market.

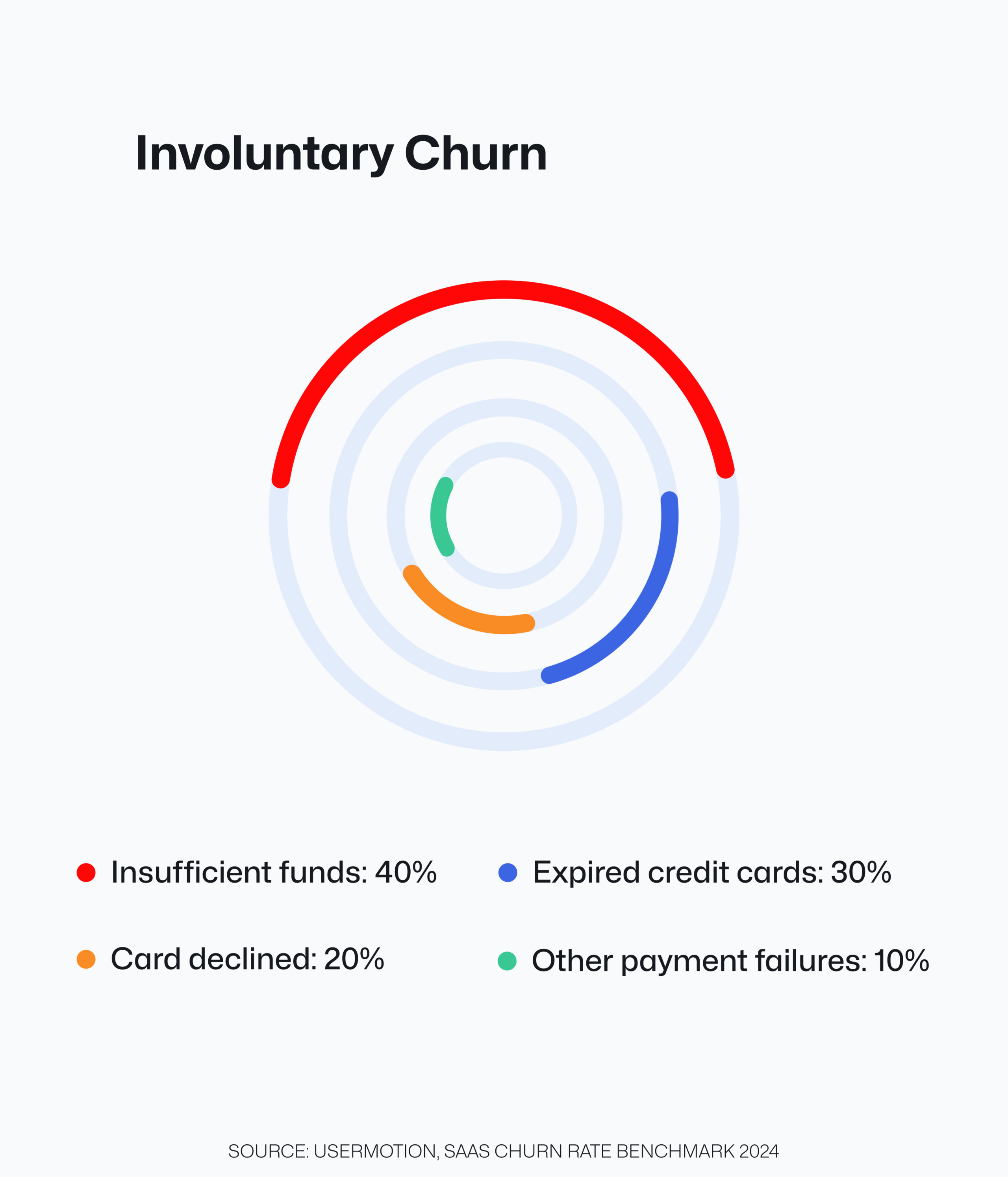

Involuntary churn is often caused by payment-related issues. According to 1,000 SaaS businesses, involuntary churn happens due to insufficient funds, expired credit cards, card declines and other payment failures.

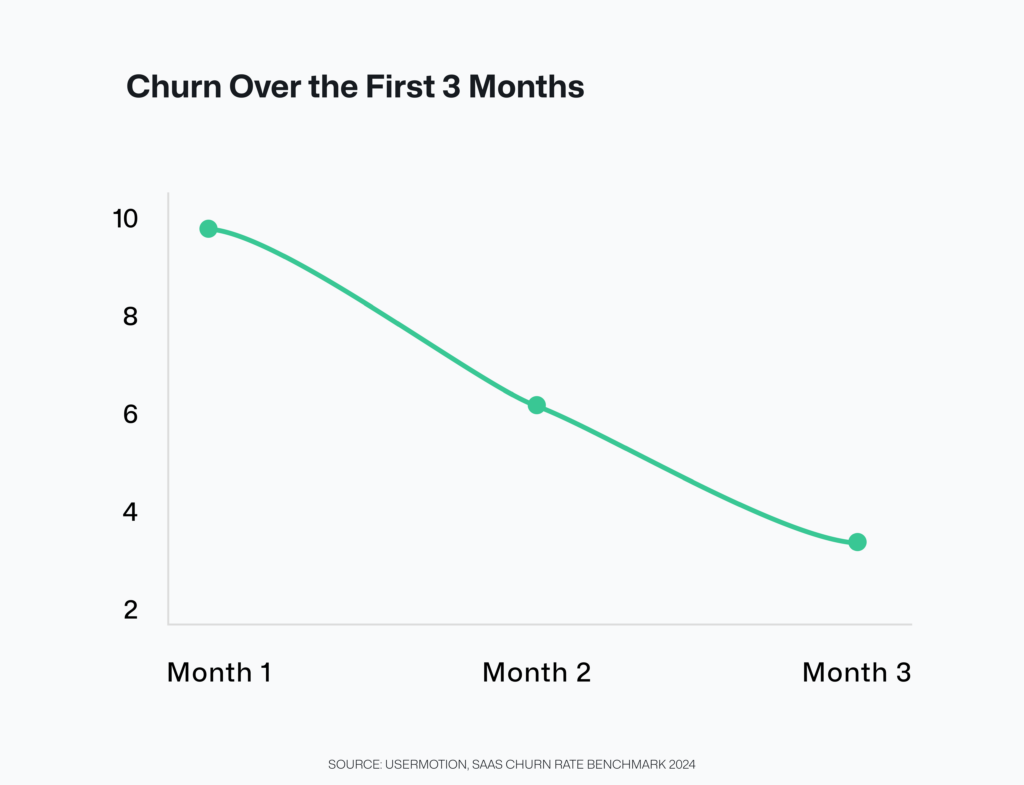

36% of 1,000 companies emphasized the first three months as critical for retention, with churn rates steadily declining from 10% in Month 1 to 4% in Month 3.

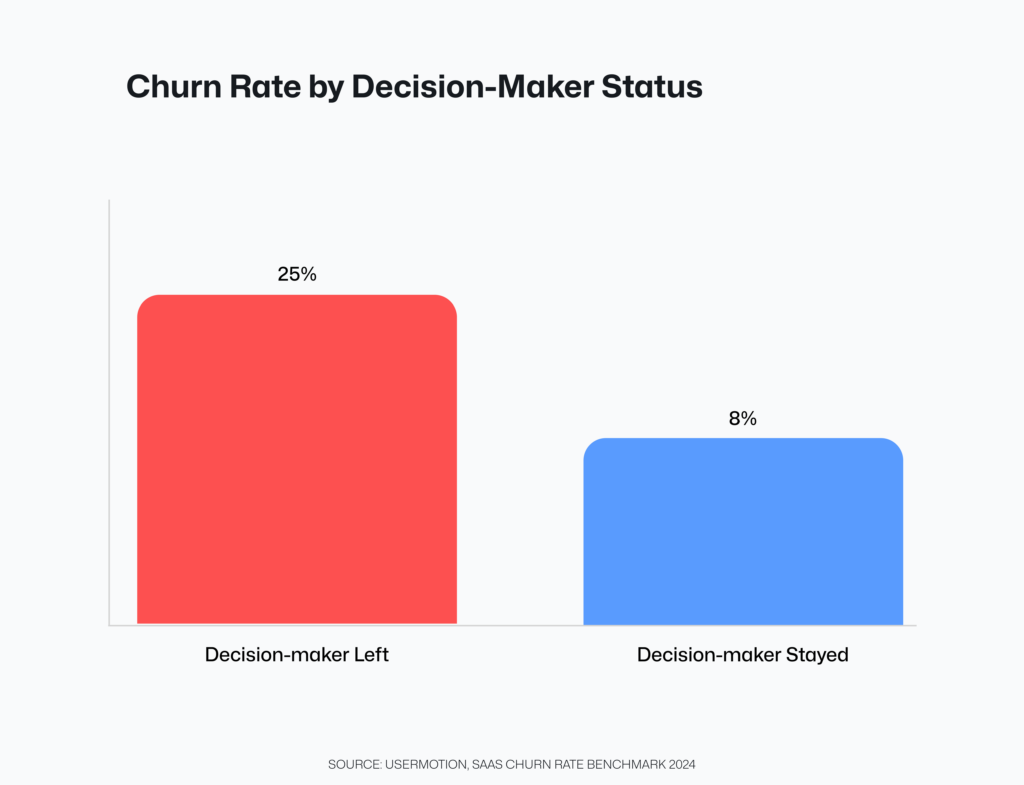

Churn is significantly higher (25%) when the decision maker leaves the company, compared to just 8% when they stay.

While cancellations dominate with a churn index of 3.2% (71.1% of total churn-related revenue loss), downgrades add another 1.3% (28.9%). Together, they result in a total churn-related revenue loss of 4.5%.

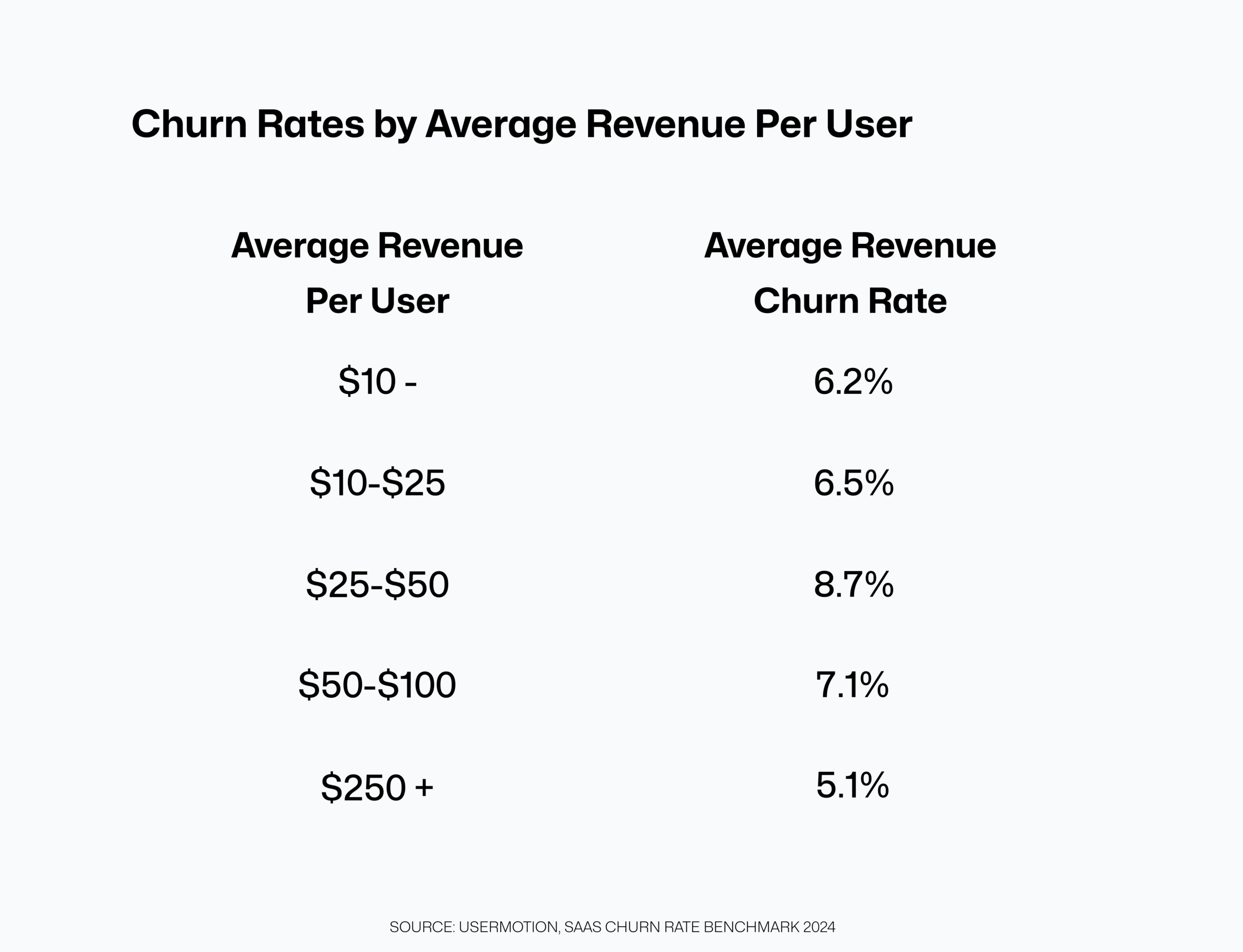

Another report found that companies with lower revenue per user tend to have higher churn rates, peaking at 8.7% for those earning $25-50 per user. Businesses with an average revenue per user (ARPU) of $10 or less face a churn rate of 6.2%, which increases to 8.7% for those with an ARPU between $25-50, before dropping to 7.1% for ARPU levels of $100-250.

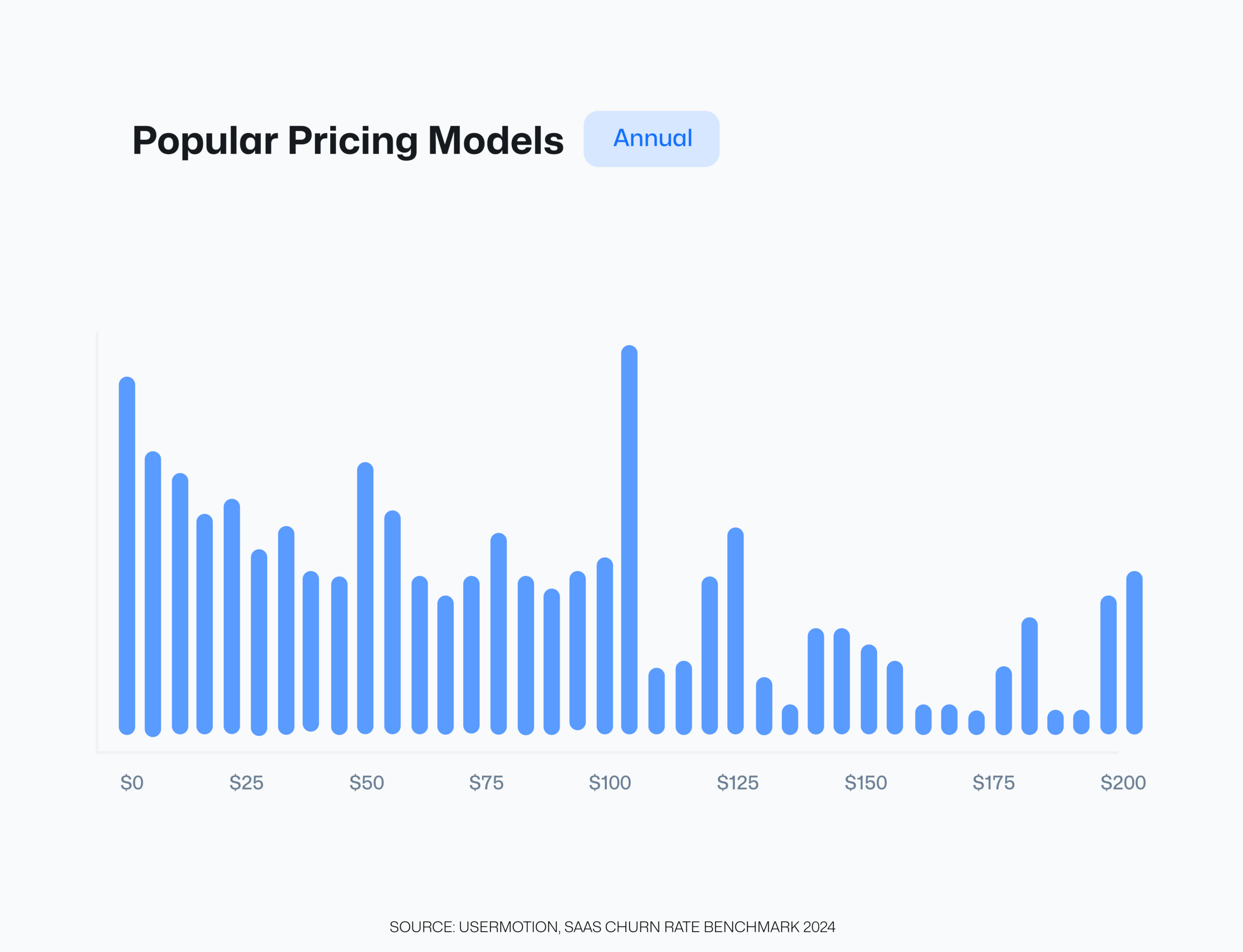

Looking at the previous insights on ARPU vs. Churn Rate, pricing models significantly influence customer retention.

For monthly plans, tiers priced around $25-$50 are among the most frequently chosen, indicating a sweet spot for affordability and value.

On the annual side, plans priced at $100-$300 dominate, reflecting a preference for cost-effective commitments when discounts are offered for yearly payments.

36% of 1,000 companies emphasized the first three months as critical for retention, with churn rates steadily declining from 10% in Month 1 to 4% in Month 3.

Churn is significantly higher (25%) when the decision maker leaves the company, compared to just 8% when they stay.

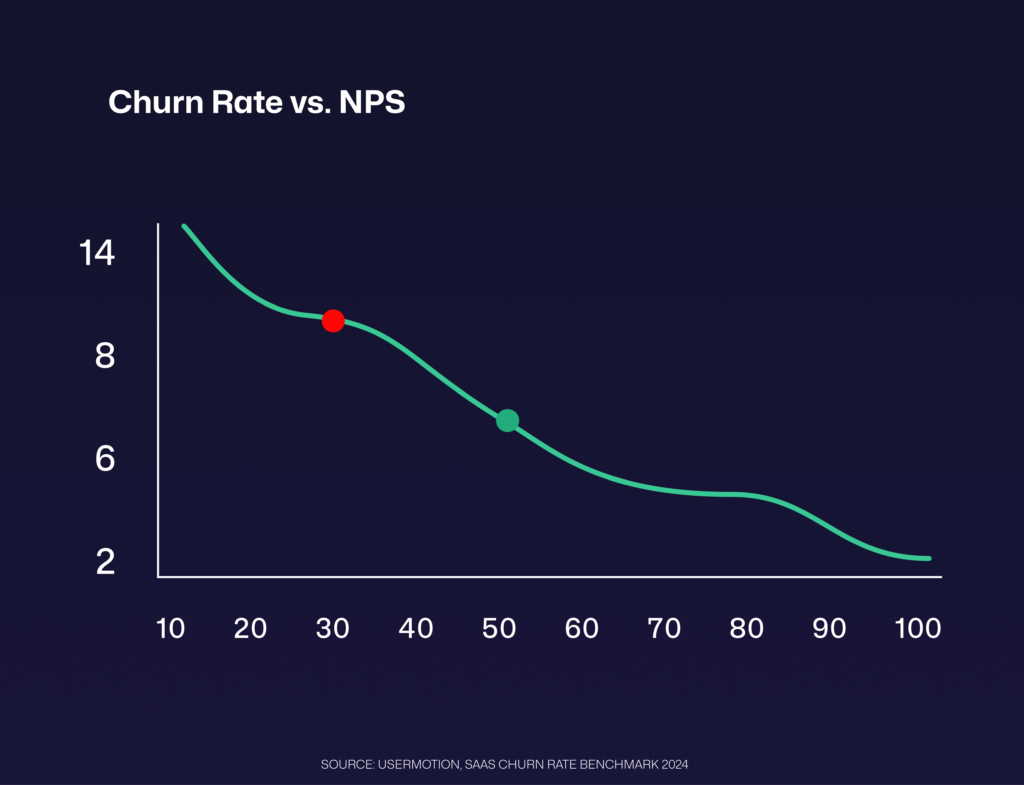

There’s a strong correlation between Net Promoter Score (NPS) and churn rates. Companies that maintain an NPS of 50 or higher experience 20% lower churn rates compared to those with an NPS below 30. High NPS reflects better customer satisfaction and loyalty, directly reducing churn.

Churn rates in B2B SaaS companies have decreased compared to the previous year, based on insights from approximately 1,000 companies. However, since the 2021 COVID boom, factors like rate hikes, slowing growth, and SVB’s collapse have made churn a significant risk for SaaS growth.

B2B customers are reducing budgets, a trend expected to continue. While new purchases can be paused quickly, cost-cutting decisions take longer to implement. By the time these changes are reflected in revenue data, market momentum has already shifted.

*We created these benchmarks based on a survey of approximately 1,000 B2B SaaS companies with MRRs between $100K and $1M and data from key industry reports. This approach provides a multifaceted perspective on churn trends in the industry.

46% of companies we have surveyed have started integrating churn prediction models into their workflows, recognizing the value of proactive customer retention.

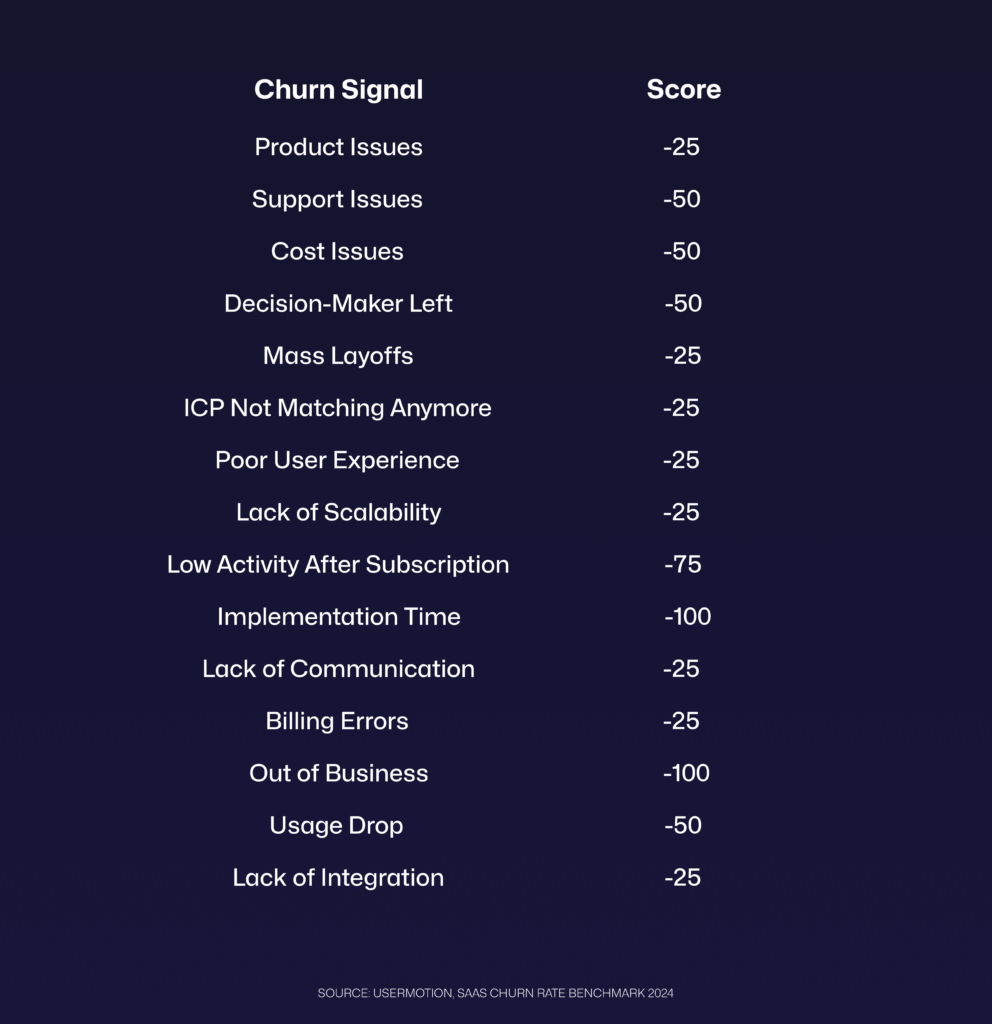

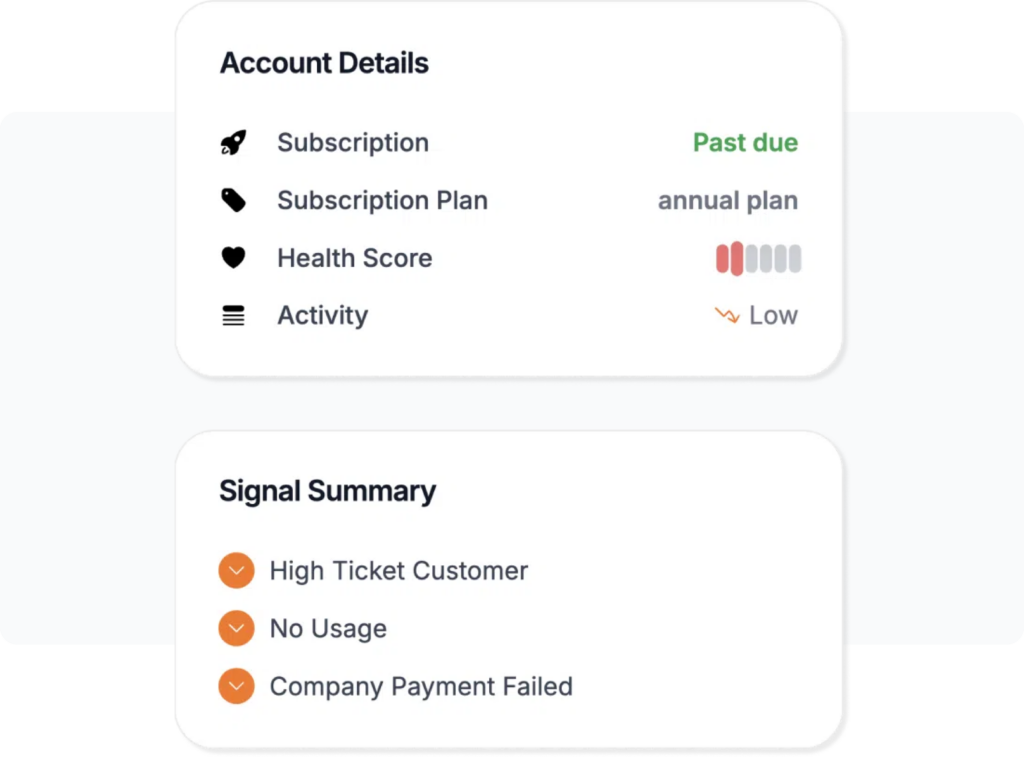

Understanding churn signals is essential for identifying at-risk customers, improving churn rates, and safeguarding your revenue.

UserMotion streamlines churn management and protects your revenue.

kovan studio, inc.